Shifting dynamics of global trade

The rules of global trade are being rewritten before our eyes. What was once a world operating under a largely predictable framework of supply chains and tariff agreements has been thrown into uncertainty, accelerated by new economic policies, strategic realignments, and retaliatory measures between major powers. This shift is sending ripples across industries and nations alike, raising questions about what the future holds for businesses and consumers.

One glaring example of this transformation is the latest round of tariffs introduced by the United States and China. The U.S. has imposed a 10% additional tariff on Chinese imports, a move described as only the beginning of broader trade measures. In direct response, China has fired back with a series of countermeasures, including 15% tariffs on U.S. coal and LNG, as well as 10% tariffs on crude oil, large engine cars, and agricultural machinery. What makes these actions particularly notable is their precision—targeting industries and companies that hold significant influence in the U.S. economy, such as major automakers like Chevrolet and Ford.

Beyond tariffs, China is also flexing its regulatory muscles by launching strict anti-trust investigations into tech giants like Google and NVIDIA, while hinting at more scrutiny for companies like Intel. This signals a broader strategy beyond just tit-for-tat trade responses—it’s about applying pressure where it hurts most. On top of this, Beijing has unveiled new export controls on critical minerals essential for high-tech manufacturing, from semiconductors to renewable energy devices. Given China’s near-monopoly on the production of these materials, nations dependent on imports are now facing difficult decisions regarding their supply chain resilience.

The global economy is now increasingly defined by fragmentation rather than cohesion. For years, businesses operated under the assumption that globalization was a one-way street—leading only toward more interconnected supply chains and freer trade. But recent events suggest that period of relative stability may be behind us. Instead, companies and governments are scrambling to secure alternative sourcing options, shifting manufacturing bases, and adapting to an environment where tariffs and regulatory roadblocks are becoming the new norm.

Meanwhile, smaller economies find themselves caught in the crossfire. Nations with strong trade ties to both the U.S. and China must navigate an increasingly complex landscape of shifting alliances and regulations. Countries previously reliant on Chinese manufacturing are now reconsidering partnerships, investing in domestic production, or shifting to alternative suppliers in regions like Southeast Asia and Latin America.

For businesses and consumers alike, this realignment means change on multiple fronts. Companies that rely on Chinese manufacturing are already looking for alternative suppliers, with sectors like technology, pharmaceuticals, and consumer goods particularly affected. The pricing of goods may become more volatile, influenced by fluctuating tariffs and uncertain trade routes. For consumers, this could translate to higher prices on everyday products, longer delays in supply chains, and potential shifts in brand availability as producers search for new ways to offset rising costs.

These emerging trade barriers are bringing about fundamental questions: Should businesses prioritize resilience over efficiency? Will supply chains become less global and more regional? And, most importantly, how will this reshape the global economic order in the years to come?

As we watch these trade realignments unfold, one thing is clear—internal and external pressures are pushing economies into a new, less predictable era. The days of assuming a smooth, globalized trade flow may be fading, replaced by a world where economic strategy, security, and geopolitical leverage dictate the terms of business like never before.

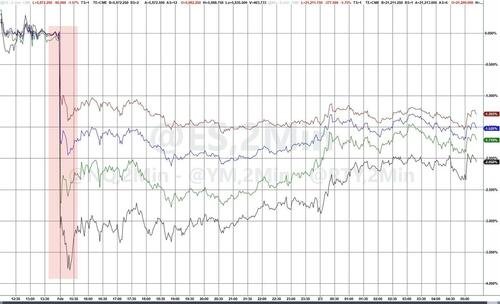

As these tectonic shifts in global trade ripple through the economy, financial markets are responding with both volatility and intriguing patterns that reflect the uncertainty of the times. Investors, policymakers, and business leaders are parsing complex signals to determine not only what is happening now but how the financial landscape might evolve in response to ongoing geopolitical and economic tensions.

In the immediate aftermath of economic and policy announcements, markets are riding waves of uncertainty, with sharp relief rallies followed by cautionary pullbacks. For example, U.S. stocks saw upward momentum despite looming trade conflicts, driven in part by favorable interpretations of domestic economic data and a pause in aggressive Federal Reserve rate hikes. However, beneath the surface, there is evident divergence between sectors. Technology stocks, for instance, are showing significant resilience as investors bet on their long-term value, even as they face regulatory scrutiny abroad and potential supply chain disruptions.

The bond markets, meanwhile, are telling a story of risk recalibration. The drop in 10-year Treasury yields reflects an appetite for safe-haven assets as the turbulence of global realignments grows harder to ignore. Yet, investors seem caught between competing narratives—balancing fears of a slowdown in growth with hopes that central banks will keep policy supportive. While inflation continues to cool in some segments, the pressures from new tariffs and supply chain rejigging threaten to complicate this trajectory, making the bond market’s next move hard to predict.

In the commodities realm, price action across oil and gold mirrors these economic and geopolitical recalibrations. Crude oil, for instance, is being buffeted by a range of forces—from U.S.-China tariff dynamics to maneuverings in the Middle East. While WTI crude prices faltered under the weight of Chinese tariffs on U.S. energy exports, Brent crude gained marginally, bolstered by fears surrounding tightened supply from Iran. This divergence between the two benchmarks is becoming increasingly indicative of the fractured nature of global commodity markets in a world of shifting alliances and power plays.

Gold’s all-time high speaks to deeper undercurrents of fear and hedging in a world that seems headed into uncharted waters. Both institutional investors and central banks are reassessing the role of hard assets in a future where asset freezes, sanctions, and financial isolation could become more commonplace. For central banks, the race to build reserves in assets immune to geopolitical retaliation, like gold, shows a clear pivot. Meanwhile, individual investors, reeling from inflationary pressures and uncertain growth prospects, are reinforcing their portfolios with what has historically been a safe store of value.

Interestingly, certain historical patterns are diverging. Consider the traditional link between the copper/gold ratio and 10-year Treasury yields. This connection has weakened, suggesting that markets are grappling with conflicting macroeconomic forces. Typically, a rise in copper prices—which reflect industrial activity—over gold signals optimism about economic growth. Today, the persistent demand for gold is competing with the faint stirrings of recovery in industrial metals like copper—a dichotomy that further highlights the fractured nature of the global economy.

Foreign exchange markets are experiencing their own recalibrations. The U.S. dollar, previously a haven for investors amid uncertainty, has shown signs of softening. This decline reflects shifting dynamics, as countries diversify reserves away from the dollar amid fears of weaponized economic policies. Meanwhile, regional currencies in areas aligned with fast-growing trade partnerships—such as Southeast Asia—are presenting growing opportunities for investors looking beyond traditional safe harbors.

For supply chain managers and financial risk professionals, these segmented and fluctuating market moves present both challenges and opportunities. The often incidental “basis effects” that arise from regional tariffs, sanctions, and national policies are creating entirely new risk categories. This increases the pressure on risk management strategies, which must now account for non-linear shocks and region-specific volatility—a daunting but not insurmountable task in the era of data analytics and predictive modeling.

It’s a reminder that navigating this turbulent financial landscape requires a blend of adaptability and foresight. Strategies once centered on stability and efficiency must now pivot toward building resilience and accommodating the unforeseen. As we move through this reordering, financial markets are becoming more than mere barometers of economic sentiment—they are active participants in shaping how the next chapter of global economics and strategy unfolds.

Geopolitical tensions have a unique way of spilling over into nearly every facet of daily life—economics, security, and even the availability of everyday goods. For many, these tensions provoke a range of emotions, from outright anxiety to a cautious curiosity about how these rapid changes could shape the future. The past few weeks, marked by increasingly unpredictable statecraft, have served as sharp reminders of just how interconnected and fragile the balance of global power truly is.

If you’ve been feeling unsettled by recent headlines, you’re not alone. Escalations like the shifting stance of the U.S. on Israel and Palestine, China’s strategic maneuvers with trade and resources, or Turkey’s growing assertiveness in former Ottoman territories are not just blips on the geopolitical radar—they are profound changes that may ripple across borders for decades. Questions multiply: What do these moves mean for global stability? How will they impact ordinary lives? For starters, let’s unpack the layers of this complexity to make sense of where things are heading.

The U.S. government’s shifting geopolitical priorities are making waves, particularly in regions already fraught with long-standing tensions. President Trump’s joint press conference with Israeli Prime Minister Netanyahu grabbed international headlines as plans for redeveloping Gaza into a cosmopolitan “Riviera” were revealed. While the rhetoric paints a vision of prosperity and peace, the practicalities raise eyebrows. The proposed relocation of Gaza’s entire population to neighboring Jordan and Egypt has been met with resistance by those countries. This kind of tension, with its deep cultural and territorial implications, forces us to ask whether bold economic initiatives can ever truly replace the need for careful diplomacy and cooperation. Moreover, the potential fallout for Western shipping channels near the Suez Canal adds another layer of uncertainty for industries globally dependent on this critical passageway.

Elsewhere, signs of strategic realignment are impossible to ignore. As China and the U.S. lock horns over trade and influence, smaller nations and regions are being forced to choose sides—or face the risky proposition of trying to remain neutral. In Panama, negotiations regarding the control of its canal exemplify how smaller players often find themselves in the uncomfortable position of balancing competing pressures. Reports suggesting Panama may revoke contracts with Hong Kong-based Hutchison Ports send a clear message: infrastructure tied too closely to one superpower or the other now faces intense scrutiny in the geopolitical chess game. Vital global trade routes like the Panama Canal or the Suez are no longer just convenient pathways for commerce; they’ve become leverage points in larger, high-stakes political disputes.

Yet, beyond the headlines, this new era of global competition is introducing a level of unpredictability that challenges traditional notions of statecraft. Relationships between nations are becoming more transactional, with leaders focusing on immediate strategic advantages rather than long-term partnerships. This is evident in growing rumors of a two-state solution’s removal from discourse on the Israeli-Palestinian conflict—a dramatic shift that may pave the way for new alignments, such as Israel-Saudi normalization, but at what cost? The stakes are no longer strictly tied to resolving historical disputes but increasingly connected to who controls resources, supply chains, and strategic leverage points.

Take the Middle East as another example. Increased hostility between the U.S. and Iran continues to raise eyebrows, with Washington signaling its readiness to escalate economic and military pressures further. In this boiling-over regional landscape, Saudi Arabia positions itself as a potential beneficiary of emerging deals with Israel, yet it also remains wary of how these developments could affect its delicate tightrope walk in global diplomacy. Adding to the pressure, Turkey is finalizing agreements to establish defense bases in formerly Ottoman-controlled Syrian territories. While Turkey’s motivations often reference historical ties, the move also signals its intent to solidify its standing as a key geopolitical player, further complicating dynamics in a region already steeped in mistrust and rivalries.

These issues have implications far beyond their immediate geographic locales. Regions untouched by these moves are not immune. Consider the knock-on effects on global energy prices, trade partnerships, and even security policies in Europe and Asia. This web of escalating tensions carries an undercurrent woven with shared global vulnerabilities. The realignment of power isn’t just about winners and losers; it’s introducing new rules that businesses, governments, and citizens alike will need to navigate.

And yet, amidst all this upheaval, there is room for resilience and adaptation. It’s crucial to acknowledge that battles of influence and control are not always fought with armies or sanctions alone; they are waged with innovations, collaborations, and the ability to reimagine priorities. Countries locked in seemingly intractable disputes may yet find ways to recalibrate their relationships or generate new approaches entirely. The challenge lies in making room for diplomacy, sustainable partnerships, and, above all, a steadfast focus on ensuring that the pursuit of power does not trample over the very people these policies and maneuvers should aim to serve.

As observers and participants in this evolving world, we are being invited to ask not just what changes are happening but how we, too, might rise to meet them—whether as voters, business decision-makers, or engaged global citizens. These geopolitical tensions demand our attention, but they also call for us to cultivate optimism and actively seek adaptive paths forward. The world is in flux, yes, but that also means it’s brimming with opportunities to innovate, collaborate, and redefine the way nations and communities interact on a global scale.

Strategic statecraft has always been a delicate balance of foresight, negotiation, and decisive action. Yet, in today’s rapidly shifting geopolitical landscape, the nature of statecraft itself is being redefined. The interconnected web of global alliances and rivalries is now unraveled and rewoven with unprecedented speed. For individuals watching these changes unfold—from policymakers to businesses and everyday citizens—the sheer scope of this transformation can feel overwhelming. But within these challenges lie new opportunities to build a more resilient and adaptable world.

At the heart of this transformation is the realization that the term “statecraft” has expanded well beyond traditional diplomacy. It now encompasses the strategic use of trade policies, technological innovation, economic dependencies, and even social narratives to achieve desired national outcomes. Countries are no longer relying solely on treaties and summits to assert their influence. Instead, a more transactional and tactical approach has taken center stage, one where quick gains often overshadow long-term strategies. While such moves can drive immediate economic or political advantages, they also risk creating unstable foundations for future global cooperation.

Consider the ongoing race for dominance in critical industries like semiconductors, artificial intelligence, and renewable energy. These sectors are no longer mere economic interests; they are battlegrounds for geopolitical leverage. The United States, China, and the European Union are all crafting policies to secure dominance in these arenas, whether through subsidies, export controls, or strategic alliances with private companies. While these efforts might spur innovation in the short term, they also create fault lines in global supply chains and increase the risk of technological silos—where cooperation gives way to competition, and regional ecosystems operate in isolation rather than collaboration.

Meanwhile, smaller nations are finding themselves thrust into the spotlight, often feeling the weight of competing pressures. In a world where strategic partnerships have become increasingly transactional, relationships are reassessed not on the basis of past goodwill but through the lens of present utility. These dynamics play out not just in high-stakes negotiations but also in the very infrastructure and resources that underpin global commerce. Control over chokepoints like the Panama Canal or emerging digital frontiers like satellite networks is regarded as not just an economic advantage but a powerful bargaining chip in the global geopolitical order.

This era of strategic statecraft is also being shaped by the growing importance of public perception. Leaders now use social media platforms, televised announcements, and public rhetoric strategically, wielding influence not just on the global stage but also within their own nations. The narratives they craft are designed to bolster domestic support, often framing geopolitical maneuvers as victories of national pride or security over external threats. Yet, the intensity of this messaging risks deepening mistrust between nations, leaving less room for nuanced dialogue and mutual understanding.

For businesses, navigating this new reality requires not only a keen eye on the rapidly changing political horizon but also a proactive approach to resilience. Relocating supply chains, diversifying markets, and investing in relationships with governments are now essential strategies. While this may introduce significant costs in the short term, those who prepare for a fragmented and unpredictable geopolitical landscape will be better positioned to weather future disruptions.

For individuals, the implications of strategic statecraft are equally personal. Rising prices, shifting job markets, and changing national priorities are bound to touch lives everywhere. But understanding the ‘why’ behind these shifts can provide clarity and even agency. It reminds us that these global maneuvers—however distant they may seem—connect back to the everyday decisions made by citizens, from what they buy to how they vote. Staying informed, engaged, and adaptable is not just a means of coping but an opportunity to contribute meaningfully to the direction the world is heading.

It’s easy to dwell on the headlines of conflict and competition that dominate the news cycles. But this period of intense strategic recalibration also offers humanity the chance to reimagine what global cooperation could look like. Not all statecraft must aim for dominance or division. As new challenges like climate change and emerging diseases test the collective resolve of nations, the need for shared innovation and collaboration has never been more apparent. The question is whether the world’s leaders can set aside short-term gains to focus on solutions that benefit all.

The unpredictable nature of this new world order might feel destabilizing, especially for those who grew accustomed to the relative stability of previous decades. But history teaches us that transformation often brings progress, even if it comes at the cost of comfort and certainty along the way. As the rules of strategic statecraft continue to evolve, there lies an opportunity for nations, businesses, and individuals to redefine the future—together. The tools, resources, and ambitions are all there; what remains is the willingness to wield them with wisdom and purpose.