Market reactions to tariff updates

Markets are always a reflection of collective sentiment, and there’s no clearer example of that than the movement we’re seeing in response to the latest tariff updates. For many of you, watching the stock indices take a tumble may feel unsettling—and that’s completely valid. It’s natural to feel apprehensive when the headlines are filled with uncertainty. But let’s take a step back and dissect what’s happening to better understand the picture.

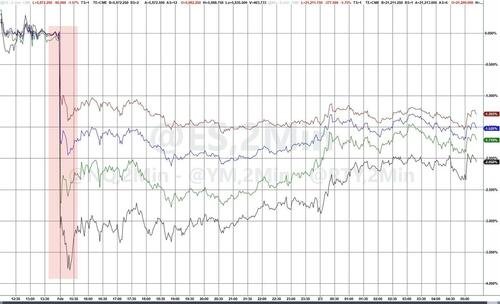

U.S. stock futures started the week in decline, with major indices such as the S&P 500, Nasdaq 100, and Russell 2000 all taking hits. Futures were down by 1.5% to 2%, though notably, those drops seemed less steep than earlier overnight activity. This type of market behavior is a vivid reminder of how quickly traders assess new developments and recalibrate their expectations. It’s important to remember that the markets may overreact in the short term, but they tend to settle into more rational patterns as the bigger picture becomes clearer.

One interesting pattern emerging is the differential in how these indices are performing. The Russell 2000, which is known for tracking smaller-cap companies, is taking the largest hit. This makes sense when you consider that smaller firms generally face greater challenges in adapting to increased costs or logistical hurdles caused by tariffs. They often lack the diverse supply chains or international exposure that helps cushion larger corporations against such shocks.

Meanwhile, the Nasdaq 100, home to many tech giants, is underperforming the S&P 500 slightly, likely due to the strong dollar. A rising dollar often negatively affects companies with a global presence, as it makes U.S.-produced goods more expensive abroad, constraining profits. For innovative industries like technology that rely heavily on international sales, the pressure from a strong dollar can feel more acute.

What does all of this mean for individual investors? If you’re watching your portfolio fluctuate and it feels like a rollercoaster, know that you’re not alone in feeling that discomfort. It’s important, however, not to make emotional trading decisions during volatile periods. Historically, markets have proven resilient, and today’s downturns often pave the way for opportunities in the future. As unsettling as it might be to see declines, this could also be a time to evaluate your long-term strategy and consider if gradual, well-informed adjustments might better position you for recovery when the dust settles.

While these stock movements may seem chaotic, they are following a fairly logical pattern given the context of tariffs and their far-reaching implications. Staying informed, measured, and patient can help guide you through this period with clarity and confidence. You’re part of a complex and connected market system that will self-correct over time—sometimes, it’s just about holding your ground and trusting the broader trajectory to steady itself.

The bond market might seem like a quieter corner of the financial world, but its reaction to tariff news speaks volumes about current economic sentiment. If you’re feeling the squeeze of uncertainty, rest assured that you’re not alone—bonds often act as a barometer of investor anxiety, and their movements give us crucial insights into what might lie ahead. Let’s unpack what’s happening with the yield curve and what it could mean for you.

As tariff updates ripple through the markets, the short end of the U.S. Treasury yield curve—that is, bonds maturing within a few years—has seen a slight uptick in yields. This move makes sense when you consider the Federal Reserve’s role in these scenarios. With uncertainty around inflation driven by tariff-induced commodity price increases, the Fed is likely to stay cautious, holding its ground rather than rushing to cut rates. Inflation concerns, even if only short-term, introduce just enough risk to keep short-term yields from dipping too far.

On the other hand, yields at the longer end of the curve—the 10-year and 30-year Treasuries—are trending lower. Why is this happening? It’s largely due to concerns around long-term economic growth. Tariffs, especially on critical goods, can dampen business investments, disrupt supply chains, and slow down consumer spending. Investors flock to long-term Treasuries as a safe haven during such uncertain times, driving their prices up and their yields down. This pattern is often a signal that markets are bracing for slower growth ahead.

The yield curve, which plots yields across various maturities, is worth paying close attention to right now. It’s beginning to show signs of flattening, and in some cases, even partial inversion. Historically, an inverted yield curve—where short-term yields exceed long-term ones—has been a warning signal of an impending economic slowdown. While we’re not entirely there yet, the subtle shifts in the curve should prompt caution and further scrutiny.

What’s striking here is the interplay between short-term and long-term expectations. On one hand, there’s acknowledgment of near-term inflation risks fueled by higher tariffs and commodity price pressures. On the other hand, there’s a looming fear that these same tariffs could dampen global trade and stifle growth over the longer horizon. It’s a delicate balancing act, and right now, the bond market reflects that tension.

If you’re an investor navigating this environment, it might feel intimidating trying to figure out what’s next. Should you tilt toward short maturities for protection against volatility, or position further out on the curve for safety during economic slowdowns? The good news is that bonds remain one of the most versatile tools in your financial toolkit. Consider diversifying across maturities to strike a balance between capturing yield and hedging against longer-term risks. It’s not about predicting the future perfectly but rather preparing for a range of outcomes.

As we watch bond yields evolve alongside tariff developments, remember that these changes are part of a larger narrative—one that markets are still piecing together. By staying informed and adaptable, you can weather these storms and find opportunities within the shifts. The bond market, though complex, offers signals and strategies that can help you navigate uncertainty with greater confidence.

Commodities are often the canary in the coal mine when it comes to assessing how global events like tariffs are impacting the real economy. For those of you closely watching energy, metals, or agricultural markets, the price fluctuations can feel worrying—not just for what they mean for investors, but for the ripple effects on everyday costs like fuel or food. It’s a lot to take in, so let’s break this down together and better understand what’s happening and why.

First, let’s talk energy. Across the board, we’re seeing a surge in prices, particularly in NYMEX gasoline and heating oil. This uptick reflects growing concerns about supply chain disruptions and elevated costs related to tariff policies. Although Canada’s energy exports were spared the steepest tariff rates (10% versus 25%), there’s still no escaping the fact that the increased cost of doing business will eventually filter down to consumers. For those of you reliant on road travel or home heating systems, the thought of added expenses at the pump or higher utility bills can understandably feel like a punch to the gut. It’s a stark reminder of how interconnected our energy needs are with global trade policies.

Beyond energy, agricultural commodities are also feeling the heat. Tariffs on specific imports, such as soybeans or corn, are creating ripple effects far beyond the farm fields they originate from. For U.S. farmers, who are already contending with uncertain weather patterns and tight margins, this added layer of complexity could be a tipping point for financial stress. If you work in or are tied to agricultural communities, you might be grappling with questions about market access or government support to offset these tariff burdens. These concerns are real, and it’s okay to feel frustrated or even helpless as these shocks unfold.

Precious and industrial metals round out the commodity landscape, and here too, the narrative is mixed. Gold, often seen as a safe haven in times of uncertainty, has remained relatively stable, reflecting cautious optimism from investors seeking a hedge against volatility. In contrast, industrial metals like steel and aluminum are stuck in a tug-of-war between global supply disruptions and the reduced demand that tariff-induced slowdowns tend to bring. For industries dependent on these materials, including construction and manufacturing, navigating rising costs is becoming a tightrope act. If you’re in one of these fields or tied to businesses directly impacted, it’s completely valid to feel anxious about how these pressures could trickle down to employment or operational challenges.

Where does this leave us? The ripple effect on commodities is not just about numbers on a screen—it’s about real-world realities that touch almost every corner of the economy. Rising energy prices may impact the cost of transporting goods, which in turn affects retail prices. Increasing agricultural tariffs could force tougher choices at the grocery store. And for industries reliant on metals, higher operational costs might lead to delays in projects or reduced profitability. These are complex and interconnected shifts that can feel overwhelming, but they also offer opportunities for adaptation and resilience.

If you’re wondering what steps you can take, consider focusing on what’s within your control. For businesses, this might mean evaluating supply chains for inefficiencies or exploring alternative sourcing arrangements to offset tariff impacts. For individual consumers, it could mean taking small, practical steps—like budgeting for rising fuel costs or seeking out new ways to economize on energy use at home. If you’re an investor, it’s worth considering whether now is the time to revisit your exposure to commodity-linked assets, balancing for both risk and opportunity as these price swings play out.

Above all, remember that markets—and the disruptions they experience—are dynamic. While the immediate effects can feel unsettling, history has shown that both economies and industries have remarkable capacities to adjust over time. By staying informed and proactive, you give yourself the tools to navigate these shifts with greater certainty and confidence. Change, as challenging as it may be, often lays the groundwork for innovation and growth on the other side.

The currency markets, always hyper-responsive to geopolitical shifts, are now squarely in the crosshairs of tariff turmoil. For many of you watching the drastic movements in exchange rates, it might feel like yet another layer of unpredictability in an already complicated global economy. If you’re feeling worried about what this means for your buying power, investments, or future plans, you’re not alone. Let’s break this down together to better understand the dynamics at play and explore how best to navigate this turbulent terrain.

The recent tariff developments have sent ripples through forex markets, most notably weakening the Canadian dollar and the Euro against the U.S. dollar. This isn’t surprising, as tariff policies often strain the economies of trading partners more heavily reliant on exports. For our neighbors to the north, the tariff spotlight has shone particularly bright. With U.S.-imposed levies impacting critical goods, including energy and raw materials, the Canadian dollar is carrying a heavy load. It’s a tangible reminder of how intertwined economies can feel shockwaves from even modest policy changes.

Meanwhile, the Euro is contending with its own struggles, not just from potential tariffs on European goods but also from broader concerns over weaker global trade growth. The interconnectedness of the European Union means that any tariff-related slowdown in one member state can quickly spread across the bloc. If you’re an international traveler or someone conducting business in the eurozone, this decline might bring mixed feelings—a strong dollar gives you more spending power abroad, but it could also signal deeper disruptions that may influence global markets down the line.

The U.S. dollar, on the other hand, has emerged as a temporary winner in this scenario, strengthening as a “safe haven” currency. While this might sound like good news for the U.S., a strong dollar comes with its own set of challenges. It makes American exports more expensive, putting additional pressure on industries like manufacturing and agriculture that are already grappling with the burden of tariffs. For multinational corporations, a stronger dollar also eats into profits earned overseas, creating hurdles for industries that thrive on global sales.

So, how does this impact you, whether you’re watching exchange rates from an investment perspective or simply trying to assess how your daily life might be affected? Let’s look at the ripple effects:

- Travel and tourism: If you’re planning international travel, the stronger U.S. dollar provides an opportunity to stretch your money further. However, in regions like Canada or Europe, you might notice higher prices for goods and services as local businesses adjust to tariff-induced costs. Stay flexible with your plans and budget for potential variability.

- Import and export dynamics: For businesses that rely on imported goods, a stronger dollar could help offset rising costs from tariffs by making global purchases cheaper. Conversely, exporters may feel the pinch as their products become less competitive in international markets. If you’re running a business impacted by these shifts, consider exploring ways to hedge currency exposure to minimize risks.

- Consumer goods pricing: Exchange rates can indirectly affect the prices of everyday items, from electronics and apparel to groceries. Tariffs might already push costs higher, and currency fluctuations could exacerbate these changes. As a consumer, focusing on smart budgeting and exploring alternatives, like locally sourced products, can help manage potential cost increases.

More broadly, currency markets can swiftly reflect the global economy’s mood, and that mood is currently skittish. What might happen from here? If trade tensions ease with clear paths forward, we could see significant reversals in forex markets. For example, the Canadian dollar and Euro might rebound sharply if progress is made on tariff negotiations. However, if tensions escalate further, additional weakening of these currencies could follow, amplifying both the risks and opportunities for those engaged in international trade or investments.

It’s also worth noting the complexities that cryptocurrencies introduce to the conversation. While digital currencies like Bitcoin are traditionally seen as detached from fiat mechanics, their rise as pseudo-safe havens in some markets adds another variable to the equation. Increased crypto-related chatter could amplify volatility in both traditional and digital currency spaces, creating unique challenges for investors trying to read the markets.

As you absorb these developments, remember that uncertainty can often bring clarity if approached strategically. If you’re an investor, think about diversifying your currency holdings, or consider forex hedging tools to shield against downside risks. For those of you budgeting for daily costs or planning international transactions, building flexibility into your financial plans could provide much-needed breathing room. Staying adaptable, calm, and informed during uncertain times is a precious skill—and this period is an opportunity to sharpen it.

Ultimately, the pressures on global currencies underscore how interconnected markets have become. While current conditions may feel overwhelming, they’re also a powerful reminder of the importance of vigilance and preparedness. Markets, like currencies, are perpetually in motion. The ability to flow and adapt alongside them equips you to navigate challenges and seize opportunities when equilibrium inevitably returns.

The cryptocurrency markets, once a seemingly untouchable realm of innovation and disruption, have found themselves increasingly intertwined with the broader macroeconomic landscape. If you’ve been watching Bitcoin and altcoins stumble under the weight of recent volatility, it’s okay to feel a little unnerved. For many, crypto has represented a promise of independence from traditional financial systems—and seeing it react so sharply to external forces like tariffs can feel disheartening. But together, let’s unpack why this is happening and how it fits into the bigger picture.

Over the past few years, cryptocurrencies have transitioned from niche digital assets to a more integrated—albeit volatile—part of the global market ecosystem. This shift means that when macroeconomic headwinds, such as tariffs, hit traditional sectors, ripples are increasingly being felt in the crypto space as well. Most notable has been Bitcoin’s price action, which has often been seen as an indicator of broader sentiment in the sector. The recent sell-off came as a surprise to many, aligning with broader risk-off behavior in equities and heightened economic uncertainty. And while it may be tempting to see this as a sign of crypto’s instability, it’s part of a larger narrative that’s worth exploring.

One reason for the sharp movements in cryptocurrencies during periods of tariff-induced volatility is the growing overlap between traditional markets and digital assets. Investments like crypto ETFs, publicly traded companies with significant exposure to cryptocurrencies, and institutional interest in Bitcoin mean that crypto is no longer existing on an island. In some ways, this is progress—it signifies mainstream adoption and validation—but it also means that crypto markets are becoming more susceptible to the same forces that drive other asset classes.

It’s also important to note the role that sentiment and liquidity play in the crypto space. Unlike traditional markets, which are relatively mature and liquid, the crypto market can be more sensitive to shifts in sentiment due to its relatively smaller size and concentrated ownership of coins by early adopters or large institutions. When tariffs or other macroeconomic factors trigger fear in traditional markets, the “risk-off” mentality can bleed into crypto, causing sharp sell-offs. For those of you invested in this space, it might feel disorienting—or even unfair—but understanding these dynamics can offer valuable insight into what’s happening and why.

Another layer of complexity comes from technological adoption and policy developments. While tariffs themselves may not directly impact crypto technologies, uncertainty around global trade often amplifies broader concerns about economic stability. These conditions can dampen confidence across the board, even in arenas like blockchain innovation. Additionally, chatter about potential regulations—whether related to tax treatments, security laws, or energy consumption for mining—tends to correlate with periods of volatility, as participants try to anticipate what’s next.

So, what does all this mean for crypto investors like you? Here are a few points to consider:

- Stay grounded in purpose: If you entered the crypto space with a long-term vision of its transformative potential, don’t let short-term volatility discourage you. Remember your reasons for investing—whether they revolve around decentralization, blockchain technology, or portfolio diversification.

- Manage expectations: While crypto presents exciting opportunities, it’s inherently more volatile than many traditional assets. Accepting this as part of the journey can help you stay committed during rough patches.

- Evaluate exposure: Given crypto’s increasing ties to traditional markets, consider how much risk you’re willing to take. Diversify your broader portfolio to cushion any potential downturns in digital assets.

- Follow the bigger picture: Crypto markets don’t exist in isolation—global economic factors like interest rates, inflation, and yes, even tariffs, play a role. Keeping an eye on these broader trends can inform more confident decision-making.

It’s also worth exploring the intersections between crypto and equities. The convergence of the two—through ETFs, blockchain-focused public companies, or even industries integrating blockchain technology—means that the performance of one often influences the other. While this may create new vulnerabilities, it also opens doors for innovative investment strategies. Understanding these connections can empower you to position yourself more strategically in this new, hybrid landscape.

At the end of the day, crypto’s response to tariffs and other market forces reflects the growing pains of a young asset class finding its place in a complex global economy. But what’s encouraging is that through every dip, slowdown, or challenge, crypto has shown remarkable resilience. It’s constantly evolving, fueled by the innovation and determination of a passionate community. If you feel discouraged by the recent turmoil, take this as a moment to reflect, regroup, and remember that growth often comes from navigating challenges. History has shown that markets, both traditional and digital, have a tendency to recover—and often emerge stronger in their aftermath.